.jpg)

It should come as no surprise that oil is the most valuable widespread global commodity in Western civilization. In relative value terms, oil has surpassed gold. A broad range of uses including energy, transportation and non-energy/material uses are, in large part, the reason for this. Industry uses just under ten percent of the refined crude oil in order to manufacture goods and services. Commercial, residential and agricultural sectors use just under thirteen percent--much of that for heating and electricity. Non-energy uses of hydrocarbons include plastics, synthetic clothing (eg. polyester), cleaning and lubricating agents, as well as binders like asphalt. Eighty percent of the asphalt refine is used for building roads. Which leads to the sector that consumes the largest volume of crude oil--transportation. Only a few modes of widespread transportation don't consume any oil; walking, cycling and electric trains are among the few examples of these. I don't have statistics on this, but the percentage of motorized vehicles that don't consume refined oil products is probably less than 1% (hybrid-electric vehicles are still powered by oil). Between cars, trucks, boats and planes, the world consumes about sixteen billion barrels of oil each year.

Industrial consumption is already at it's lows. Heating and electricity loads are unlikely to change much in the near term (alternative energy and efficieny improvements could chip away at this in the long term). Non-energy sources are also pretty static as far as demand goes; there is an obvious reluctance to return to cotton diapers and no one likes driving on gravel roads. That pretty much leaves transportation sector to the task of reducing demand.

There are essentially two ways to reduce organic demand in the transportation sector (1) improve efficiency and (2) reduce volume. Improving efficiency implies activities like purchasing new, fuel efficient airline fleets and passenger vehicles. This requires significant capital investments and thus time before it can become a reality--even if it makes economic sense to do so. Industry leaders such as GM and Tesla Motors estimate it will take ten years and lots of government subsidies before hydrocarbon-free transportation vehicles start to become competitive in the mass markets. It will take even longer (30-40 years)* before significant market share is acquired by alternatively powered vehicles. On the volume side, while per-capita car ownership in the United States has probably peaked, passenger car ownership in emerging economies continues to skyrocket. This is part of the reason why the transport sector only amounted to 45% of total oil consumption in 1973 and is now over 61%. China and India alone would need 2 billion cars to approach the rate of car ownership that the United States has.

Given that any major initiatives to reduce dependency on oil will take time, there is really only one way to reduce near-term organic demand for oil--higher prices.

That being said, there is a level above which the price of oil will not only be self-limiting but potentially even catastrophic in contributing to a recession. In early 2008, when oil prices pushed well past $100, the transportation sector began to collapse along with the eventual low at the end of that year. This was made worse by other issues such as the subprime housing crisis, but the bottom line was that people could no longer afford to fill up their gas tanks and thus prices necessarily fell.

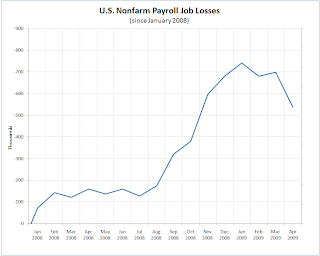

Given the continued weakness of the U.S. economy, along with rising unemployment expected to peak in 2010, a high enough price could contribute to another recession and result in another price collapse. This instability price point is probably above $80 and not as high as $150. Filtering out price corrections, the trend for oil prices would appear quite bullish based on supply and demand alone.

There is however, one final part to this story: the measuring stick (the dollar).

.png)

.jpg)